Launched New Partner Portal & Reduced Annual Costs by $1 Million in Q3 F2022

Vancouver, B.C., Canada – August 25, 2022 – Legend Power® Systems Inc. (TSX.V: LPS) (OTCQB: LPSIF) (“Legend Power” or the “Company”), a global leader in commercial electrical system solutions, reports its financial results for the three months ended June 30, 2022 (“Q3 F2022”). The Company has also scheduled a conference call to provide a business update to discuss its Q3 F2022 financial results for Thursday, August 25, 2022 at 4:00 PM ET (1:00 PM PT) (details below). The call will be hosted by Randy Buchamer, President & Chief Executive Officer. A complete set of Financial Statements and Management’s Discussion & Analysis has been filed at www.sedar.com. All dollar figures are quoted in Canadian dollars.

Q3 F2022 Highlights

- Revenue of $1.03 million versus $343 thousand in Q2 F2022 and $1.27 million in Q3 F2021

- Adjusted EBITDA loss of $1.24 million versus a $706 thousand loss in Q3 F2021

- Net loss of $1.49 million versus a $946 thousand loss in Q3 F2021

- Cash of $4.68 million, no debt, and $6.32 million in working capital at June 30, 2022. Management

believes that based on the current working capital and visibility in the business that the Company is

fully capitalized for the next twelve months - Shipped twelve of its next-generation SmartGATE systems in this quarter and is now preparing to

produce fifty more systems for upcoming quarters

Subsequent Events

- Selected for the Green Proving Ground program for the United States General Services

Administration which operates approximately 1,800 federally owned buildings - Launched new recurring revenue maintenance program

- Increased selling prices and new payment plan

- Reduced operating costs by $1 million annually, which should start to be fully recognized in the

coming months

“We’ve continued to work diligently with new and existing suppliers to secure delivery commitments for long lead-time and critical inventory components,” said Legend Power Systems CEO Randy Buchamer. “Opportunities for volume pricing discounts have been realized by way of scheduled deliveries of partial quantities, and orders for readily available materials are being postponed but monitored to optimize cash. We’ve also focused on reducing costs, including headcount reductions, and have removed almost $1 million from our annual costs, which we will realize in the coming months. The Company has a very strong sales pipeline with several opportunities that if closed would be the largest orders in the Company’s history.”

Overview of Q3 F2022 Financials

During Q3 of fiscal 2022, the Company launched the new Partner Portal and the True Cost of Power Estimator self-serve platforms. Additionally, the Company launched a new partner marketing program, which provides automated energy data logging and reporting via the Partner Portal. The reports help to validate the current state of a customer’s building, allowing for further strategic conversations.

The Company has continued to invest in its sales team and tools, as well as procurement of long-lead time materials and expanded capacity in readiness for a ramp-up in Gen3 SmartGATE demand. Investments have been timed to minimize impact on cash flow by placing orders only when needed based on current market lead times.

During this quarter, the Company continued to focus on onboarding, training, and streamlining of operations and procedures. Our sales order process has evolved to improve on-time delivery and lead time performance with the addition of tighter controls and the implementation of key performance indicators. SmartGATE installation costs have been improved with the development of an installation cost model that predicts costs based on system configuration and building characteristics. This has allowed Legend to control and manage contractor estimates, reducing costs and creating consistent standards of installation. Continuous improvement of the MRP, bill of materials (“BOM”), inventory management and the factory layout have all contributed to faster turns and greater efficiencies. We are now able to predict trends in future BOM costs, enabling us to focus on materials with the greatest opportunity for BOM cost reduction, in turn, increasing our margin potential.

The Company’s channel sales team, now 2 individuals, has grown reseller and ESCO relationships, furthering adoption of both Insights and SmartGATE solutions. Target markets and reseller channels continue to respond positively to Legend’s solutions and combined opportunities. As of the date of filing the quarter, the Company is engaged with more than 50 organizations interested in becoming Legend selling partners. The channel sales team continued development of partner support tools for the partner portal including marketing support, sales support, technical support, and deal registration.

Also, in Q3, the Company commissioned the first six Gen3 SmartGATE system and continued an aggressive build initiative to fill its backlog. The Company shipped twelve of its next-generation SmartGATE systems in this quarter and is now preparing to produce fifty more systems for upcoming quarters. Due to component deliveries, our revenue recognized during the quarter was lower than what was anticipated.

Having the Gen3 SmartGATE system reach commercial production, the engineering team continues to work on the system’s remote commands functionality, which allows the Company to communicate remotely with Gen3 SmartGATE units in the field and is the foundation of a “remote upgrade” feature. In addition, the engineering department worked on cost reduction strategies including identifying alternative suppliers and design optimization. Several cost-reduced designs are either in development or have been realized, savings will be realized once current stocks are depleted.

In response to the continued increase in costs and on-going logistic disruptions, the Company has also increased selling prices. In addition, management initiated cost cutting measures to reduce overall expenditures to be realized in the upcoming months.

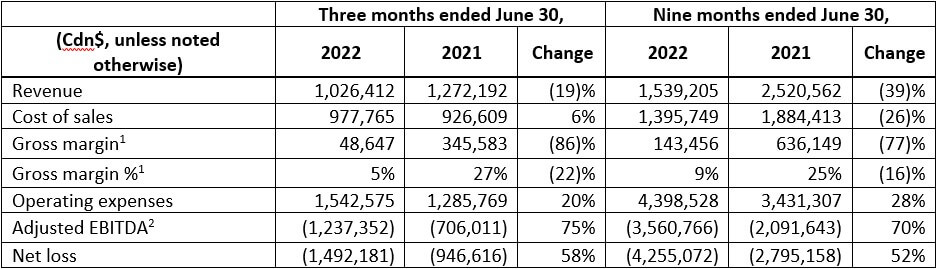

Financial summary for the three and nine months ended June 30, 2022 and 2021

1 Gross margin is based on a blend of both equipment and installation revenue.

2 Adjusted EBITDA is a non-IFRS financial measure. See EBDITA Reconciliation for details.

Revenue for the third quarter of 2022 was $1,026,412 compared with $1,272,192 in the same quarter of fiscal 2021. The lower revenue during Q3 of fiscal 2022 was primarily due to delayed product deliveries to customers as a result of inventory shortages caused by supply chain challenges and to a lesser extent, the production ramp up required for the Gen3 version of SmartGATE.

Gross margin in the third quarter of fiscal 2022 was 5%, compared with 27% in same quarter of fiscal 2021. The comparative decrease in gross margin experienced during Q3 of fiscal 2022 was due to higher cost of goods sold driven by widespread supply chain challenges, COVID-19 supplier surcharges, increased installation costs, component cost increases and an inventory provision. Management believes that with the new supply chain and operational efficiencies being deployed that long-term gross margins will return to 40%+ in the future.

The Company’s operating expenses for the third quarter of fiscal 2022 were $1,542,575, up from $1,285,769 in the same quarter of fiscal 2021. The primary cause for the increase was higher salaries and consulting costs as the Company expanded its channel sales team and the fact that internal cost cutting measures were still in place during Q3 of the prior fiscal year.

Adjusted EBITDA for the third quarter of fiscal 2022 was negative $1,237,352, compared with negative $706,011 in the same quarter of fiscal 2021.

Net loss for the third quarter of fiscal 2022 was $1,492,181, compared with a net loss of $946,616 in the same quarter of fiscal 2021. Lower gross margins and increased operating costs in Q3 of fiscal 2022 compared with the same quarter of fiscal 2021 resulted in a higher net loss.

Cash at the end of the quarter was $4.68 million. The Company has no debt and had working capital of $6.32 million. Given the challenges in supply chain and shipping that companies are experiencing around the world, management has focused on continuing to take costs out of the business while taking advantage of the large growth opportunity as our customers and potential strategic partners look to deploy our solutions throughout buildings across North America.

CONFERENCE CALL DETAILS:

Date: Thursday, August 25, 2022

Time: 4:00 PM ET (1:00 PM PT)

Dial-in Numbers: 1 (888) 396-8049

Online Listening: https://app.webinar.net/OLdyVlDVDj6

Conference ID: 02001495

Replay: Available at: legendpower.com

About Legend Power® Systems Inc.

Legend Power® Systems Inc. (www.legendpower.com) provides an intelligent energy management platform that analyzes and improves building energy challenges, significantly impacting asset management and corporate performance. Legend Power’s proven solutions support proactive executive decision-making in a complex and volatile business and energy environment. The proprietary and patented system reduces total energy consumption and power costs, while also maximizing the life of electrical equipment. Legend Power’s unique solution is also a key contributor to both corporate sustainability efforts and the meeting of utility energy efficiency targets.

For further information, please contact:

Sean Peasgood, Investor Relations

+ 1 647 503 1054

Neither the TSX Venture Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This Press Release may contain statements which constitute “forward-looking information”, including statements regarding the plans, intentions, beliefs and current expectations of the Company, its directors, or its officers with respect to the future business activities and operating performance of the Company. The words “may”, “would”, “could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” and similar expressions, as they relate to the Company, or its management, are intended to identify such forward-looking statements. Investors are cautioned that any such forward-looking statements are not guarantees of future business activities or performance and involve risks and uncertainties, and that the Company’s future business activities may differ materially from those in the forward-looking statements as a result of various factors. Such risks, uncertainties and factors are described in the periodic filings with the Canadian securities regulatory authorities, including the Company’s quarterly and annual Management’s Discussion & Analysis, which may be viewed on SEDAR at www.sedar.com. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking

statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although the Company has attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results to not be as anticipated, estimated or intended. The Company does not intend, and does not assume any obligation, to update these forward-looking statements other than as may be required by applicable law.