Vancouver, B.C., Canada – May 31, 2021 – Legend Power® Systems Inc. (TSX.V: LPS) (OTCQB: LPSIF) (“Legend Power” or the “Company”), a global leader in commercial electrical system solutions, today reported its Q2 2021 financial results for the six months ended March 31, 2021. The Company has also scheduled a conference call to provide a business update and discuss its Q2 2021 financial results for Monday, May 31, 2021, at 5:00 PM ET (2:00 PM PT). The call will be hosted by Randy Buchamer, President & Chief Executive Officer, and Steve Vanry, Chief Financial Officer (details below). A complete set of Financial Statements and Management’s Discussion & Analysis has been filed at www.sedar.com. All dollar figures are quoted in Canadian dollars.

Financial Highlights for the quarter ending March 31, 2021 (Q2 2021)

- Sales bookings of $1.92 million increased 705% versus Q2 fiscal 2020 and were up 20% from $1.6 million in Q1 fiscal 2021

- Revenue of $482k versus $676k reported in Q2 2020;

- Gross profit of $89k compared to $217k in Q2 2020;

- Adjusted EBITDA loss of $708k versus a $1.47 million loss in Q2 2020;

- Net loss of $982k versus the $1.52 million loss in Q2 2020; and

- Cash of $1.71 million, no debt, and $2.59 million in working capital on March 31, 2021.

Quarterly Update

Legend posted a robust Q2 fiscal 2021 performance with record sales bookings and strong results across previously announced growth metrics. The Company’s new “Insights-led” sales model implemented in Q4 of fiscal 2020 is outperforming internal forecasts for new customer engagements, reduced length of the sales cycle, and sales wins. The Company continued to see significant sales bookings growth both sequentially from last quarter and from the quarter a year ago.

Q2 Fiscal 2021 Growth Highlights:

- Sales bookings of $1.92 million increased 705% over Q2/2020 and were up 20% from Q1/2021

- Exceeded Q2 fiscal 2021 goal of 90 SmartGATE Insights engagements

- Exceeded goal of 50% conversion rate from SmartGATE Insights to full SmartGATE Platform sales bookings with 100% conversion from some customers

“We’ve never been more optimistic about our business and our potential to achieve significant growth,” said Randy Buchamer, CEO of Legend Power Systems. “The revamping of our sales model is resonating incredibly well with prospective and existing customers in multiple verticals across North America. Tracking our success with our Insights-led sales approach has now been distilled down to a few simple metrics, which not only provide our team with clear priorities but also gives Legend’s investing audience a definitive scorecard to track our growth.”

Legend’s SmartGATE Insights and Power Impact Report are valuable tools that provide building owners a better understanding of the financial impact the power grid is having on their buildings and how SmartGATE solutions can solve these challenges for them. The Power Impact Report details these excessive costs across each building in a property portfolio and demonstrates how SmartGATE solutions can reduce these costs.

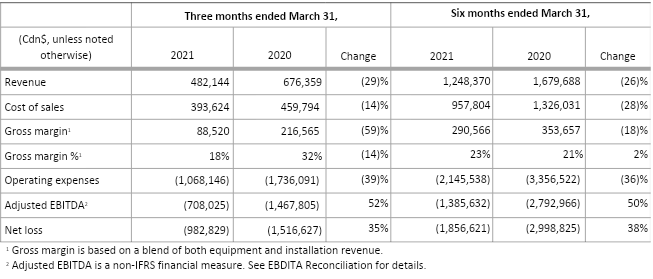

Financial summary for the three and six months ended March 31, 2021, and 2020

Revenue for the second quarter of 2021 was $482,144 down 29% from $676,359 in the same quarter of fiscal 2020. Revenue for the six months ended March 31, 2021 was 1,248,370 down 26% from $1,679,688 in the same period of fiscal 2020. During the three and six month periods ended March 31, 2021, the Company posted strong sales bookings much of which, as was the case in Q1 fiscal 2021, was not realized in revenue due to, customer-driven install scheduling, internal and external COVID related personnel constraints, and inventory supply chain delays. The revenue related to these sales is expected to be booked in Q3 and Q4 of fiscal 2021. In the absence of this timing constraint, revenue for the six months ended March 31, 2021, would have likely been materially higher than that of the comparative period of fiscal 2020.

The gross margin in the second quarter of fiscal 2021 was 18%, compared with 32% in the same quarter of fiscal 2020. The gross margin for the six months ended March 31, 2021, was 23% compared with 21% in the same period of fiscal 2020. The comparative decrease in gross margin experienced during Q2 of fiscal 2021 was due primarily to preferential pricing on sales of previous-generation SmartGATE inventory and follow-on install costs related to installations realized in prior quarters. The increase in gross margin experienced in the six months ended March 31, 2021, was primarily due to very low gross margin in Q1 of fiscal 2020 which was the result of i) a reclassification of inventory write-down to cost of goods sold of $77,000 and ii) a significant project completed for a marquee customer in a new region with unusually high install costs While gross margin has been variable while revenue has remained low due to installation delays, management believes that as the Company scales and sales bookings convert to revenue that margins should improve and be closer to long-term average results.

The Company’s operating expenses for the second quarter of fiscal 2021 were $1,068,146, down significantly from $1,736,091 in the same quarter of fiscal 2020. Operating expenses for the six months ended March 31, 2021, were 2,145,538 also down significantly from 3,356,522 in the same period of fiscal 2020. The primary cause for the decrease in the comparative fiscal periods is cost-cutting measures implemented in response to the economic slowdown caused by COVID-19, some of which remain in place today.

Adjusted EBITDA for the second quarter of fiscal 2021 was negative $708,025, compared with negative $1,467,805 in the same quarter of fiscal 2020. Adjusted EBITDA for the six months ended March 31, 2021, was negative $1,385,632 compared with negative $2,792,966 in the same period of fiscal 2020.

Net loss for the second quarter of fiscal 2021 was $982,829, compared with a net loss of $1,516,627 in the same quarter of fiscal 2020. Net loss for the six months ended March 31, 2021, was $1,856,621 compared with $2,998,825 in the same period of fiscal 2020. Reduced operating costs were the largest contributing factor to the significantly lower net losses in both comparative periods.

CONFERENCE CALL DETAILS:

| DATE: | Monday, May 31, 2021 |

|

TIME: |

5:00 PM ET (2:00 PM PT) |

| DIAL-IN NUMBER:

|

North America Toll Free Dial-in Number (877) 201-0168 International Dial-in Number – (647) 788-4901

|

| ONLINE LISTENING | https://onlinexperiences.com/Launch/QReg/ShowUUID=0306FBBC-A032-4AA4-849A-81204C49373A |

|

CONFERENCE ID: |

4363382 |

|

REPLAY: |

Available at: www.legendpower.com |

About Legend Power® Systems Inc.

Legend Power® Systems Inc. (www.legendpower.com) provides an intelligent energy management platform that analyzes and improves building energy challenges, significantly impacting asset management and corporate performance. Legend Power’s proven solutions support proactive executive decision-making in a complex and volatile business and energy environment.

The proprietary and patented system reduces total energy consumption and power costs, while also maximizing the life of electrical equipment. Legend Power’s unique solution is also a key contributor to both corporate sustainability efforts and the meeting of utility energy efficiency targets.

For further information, please contact:

Steve Vanry, CFO

+ 1 604 671 9522

Sean Peasgood, Investor Relations

+ 1 647 503 1054

Neither the TSX Venture Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.